Quickfinvest Helps You Invest Safely for The Future

We help clients formulate and implement a long-term, diversified investment strategy based on our Outsourced CIO (OCIO) operational platform.

Trusted by 100k+ Investors

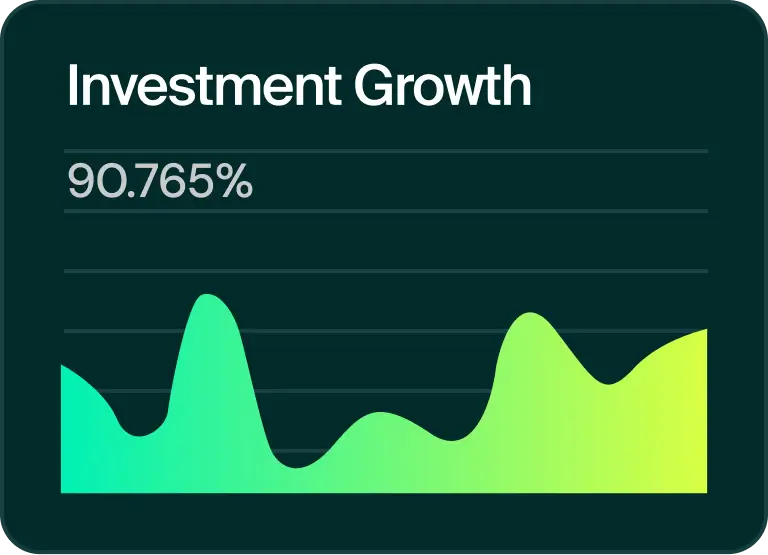

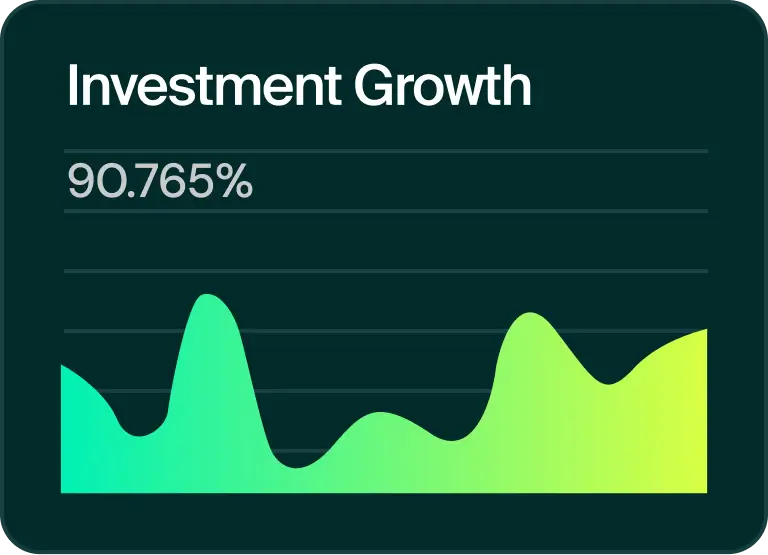

We Value Data for Informed Investing

At Quickfinvest, we use data to help you make better investment decisions. By studying the market, the economy, and how companies are doing, we guide you toward smarter choices.

Funding & Investment

At Quickfinvest, we excel at funding, investing & guiding strategic decisions.

Capital Transparency

We prioritize capital transparency. Our commitment ensures clarity.

Secure Investment Plan

With Quickfinvest, your financial future is guided by smart planning and steady growth.

What We Can Help You With

We're here to assist with your financial goals. From investments to retirement planning, count on us for expert guidance

Investment Research and Analysis

Our Investment Research and Analysis team uncovers valuable insights.

Read MoreRisk Management Solutions

Our Risk Management Solutions ensure your investments are safeguarded.

Read MoreFinancial Planning and Consultation

We offers personalized guidance to secure your financial future.

Read MoreRetirement Planning Services

Secure Your Future with Retirement Planning Services at Quickfinvest.

Read MoreSafety First

Safety First is our motto at Quickfinvest prioritizing your financial security. Trust us for stability as you pursue your goals.

Secure transactions with two-factor authentication

Trusted by 40+ million Investors worldwide

Data security with no compromises

Find the level that suits you

Find your perfect fit at Quickfinvest. We offer tailored solutions for investors at every stage. Let us guide you toward success.

- Perfect For: Business Line of Credit

- Funding Capacity Up To $250,00

- Term Up To 2 years

Features Include:

- Access to all Quickfinvest products

- Join Events, Meet Our Community

- Invest $250/yr in Quickfinvest Deal

- Access to exclusive Quickfinvest content

- 25% kickback in XKI on fees

- Perfect For: Revenue based funding

- Funding Capacity up to $2000,00

- Term up to 2 years

Features Include:

- All Premium benefits, plus

- $2000/yr investment in Quickfinvest Deal

- 50% kickback in XKI on fees

- Instant Messaging Concierge Service

- 25% kickback in XKI on fees

- Perfect For: Equipment financing

- Funding Capacity up to $750,00

- Term up to 3 - 5 years

Features Include:

- All the Titanium benefits, plus

- Unlimited investments

- 75% kickback in XKI on fees

- Private events

- Telephone concierge

- Perfect For: SVA investment

- Funding Capacity up to $5,000.00

- Term up to 10 - 25 years

Features Include:

- All the Black benefits, plus

- 90% kickback in XKI on fees

- Invest $5,000.00/yr in Quickfinvest Deal

- 15 minute priority on deals

- 25% kickback in XKI on fees

Have a question? Look Here

For quick answers, visit our FAQ section. Can't find what you need? Contact our support team.

We provide a range of services to help you reach your financial goals. These include custom investment plans, retirement solutions, and access to assets like stocks, bonds, mutual funds, and ETFs. Every strategy is built using research and tailored to match your needs and risk level. This may include stocks, bonds, mutual funds, ETFs, real estate.

At Quickfinvest, we tailor our recommendations to your goals, risk level, and timeline. We typically suggest a mix of assets like stocks for growth, bonds for stability, and ETFs for low-cost diversification. When suitable, we may also include alternatives like REITs or commodities. Your portfolio is always built to stay balanced and adjust as your needs or the market change.

Getting started is simple. First, create an account and complete a short questionnaire to help us understand your financial goals, risk tolerance, and investment timeline. Based on your profile, we’ll recommend a personalized investment plan. Once you review and approve it, we’ll handle the rest — from building your portfolio to ongoing management and rebalancing.

At Quickfinvest, risk management starts with understanding your unique comfort level and financial goals through a detailed risk assessment. We build diversified portfolios across multiple asset classes to reduce exposure to any single market or sector. Our system includes ongoing monitoring and automatic rebalancing to keep your portfolio aligned with your risk profile, especially during market shifts. Additionally, we use stress testing and scenario analysis to anticipate potential risks and adjust your investments proactively.